A Step-by-Step Guide to Opening Your Scalable Capital Account

If you want to invest in stocks, options, and ETFs, you need a Depot or depository account and Scalable Capital provides you with ease.

So, without waiting, let’s get started with opening an account with Scalable Capital!

Who Can Sign up for Scalable Capital?

Scalable Capital’s services are aimed at individuals residing in Germany, Austria, Italy, Spain, France and the Netherlands. In addition, the following requirements must be met:

- You should be over 18 years of age

- The US tax jurisdiction does not apply to you

- You are not a Swiss resident

- You have a SEPA current account

Note, however, that the custodian bank only pays taxes on the customer’s behalf if they are taxable in Germany. If you are subject to tax outside of Germany, you must make sure that all securities transactions are taxed properly. For these reasons, Scalable Capital will provide you with a tax report.

Opening a Depot With Scalable Capital. How to Get Started?

Scalable Capital has made the process very simple to sign-up for an account and can be concluded in five simple steps

- Go to Scalable Capital’s website and tap/click on the “Open Account” button. Sign up with your email address.

- After signing up and verifying with your email, select a Broker Plan. Go with a free plan to straighten your bearings.

- Fill out your personal information

- Make your first deposit

- Verify your identity.

Let’s take a look at these steps in greater details.

Step 1: Signing up for Scalable Capital Using Your Email ID

Go to Scalable Capital’s website and click on “Open Account“. We have made this process simpler for you, so go ahead and click the link above or the button below.

You will have two options. If you want to manage everything on your own, select the Broker option. It is available in English and German language. Select Wealth option, to invest in a portfolio that is managed by Scalable Capital.

Both options will redirect you to a webpage where you sign up with your Email Address. Scalable Capital will send you a verification email, which you need to follow to get to the next step.

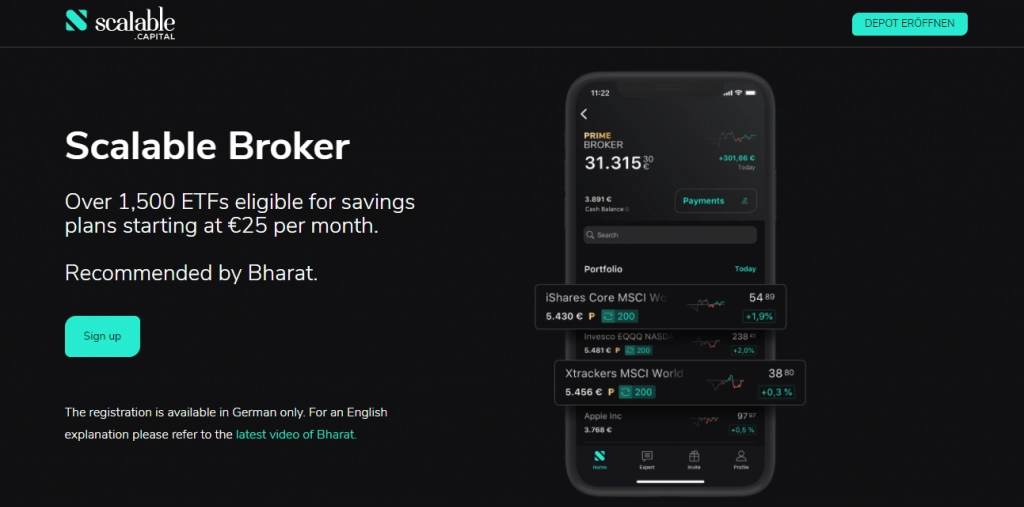

Step 2: Choose the Broker Plan of Your Choice

After you verify your email address, you will be taken to a brokerage plan page. Choose a broker plan for your depot according to your needs. You need to select one of the three plans offered by Scalable Capital: Free, Prime or Prime Flex. Each plan has different features and fees.

A) FREE Broker Plan

The Free Broker Plan does not incur monthly subscription fees. When you open a free ETF Savings Plan and invest in Scalable Capital’s PRIME PARTNER ETFs, transactions are free.

This plan allows you to trade over 4,000 ETFs and funds for free, as well as trades with an order volume of €250 or more in selected products from Invesco, iShares by BlackRock and DWS Xtrackers. The minimum amount for a savings plan starts at €25. For all other trades on Gettex, you pay €0.99 per trade. Crypto ETPs are subject to an additional spread surcharge.

These can be summarised as:

- No order fees for ETFs

- Fixed order fees of €0.99 for shares

- No account management fees

B) PRIME Broker Plan

The PRIME Broker Plan costs €2.99 per month. In addition to everything in the Free Broker Plan, it also gives you unlimited free trades for all products on Gettex, including stocks, ETFs, funds and crypto ETPs. You also get access to exclusive features such as fractional shares, smart order routing and best execution. This is actually a great advantage since it opens you up to so many options.

These can be summarised as:

- No order fees for ETFs

- No order fees for Shares

- No order fees for derivatives

- Monthly account fee of € 2.99 per month.

This is an annual subscription, which means you will pay for the whole year at the time of signing up or upgrading your account from Free Broker Depot.

C) PRIME Flex Broker Plan

The Prime Flex plan is an upgrade to the Prime plan. This plan costs €4.99 per month and gives you all the benefits of PRIME Broker plus unlimited free trades on Xetra (Germany’s largest stock exchange) for selected products from Invesco, iShares by BlackRock and DWS Xtrackers. In contrast to the PRIME Broker plan, payments for PRIME Flex are monthly.

These can be summarised as:

- No order fees for ETFs

- No order fees for Shares

- No order fees for derivatives

- Monthly account fee of €4.99 per month.

Unlike Prime Broker, Prime Flex Broker has a monthly subscription. It means you will not be charged for the whole year but on a rolling basis per month.

What Is the Difference Between Gettex and Xetra

Gettex and Xetra are both electronic trading platforms for securities in Germany. However, they have some differences:

- Xetra is the largest exchange centre in Germany by far: around 90 per cent of the sales are attributable to this platform. Gettex is a lot smaller and predominantly caters to private investors.

- Most of the trading at Gettex takes place with so-called market makers, who provide liquidity and competitive prices. Whereas Xetra is a pure stock exchange that matches buyers and sellers directly.

- The trading hours of Gettex are from 8:00 to 22:00 CET, while Xetra operates from 9:00 to 17:30 CET.

Step 3: Add Your Personal Information

Once you choose your plan, you will be taken to a page where you need to fill out your Personal information.

- Name

- Title

- Marital status

- Citizenship

- Address

- Tax Number

- IBAN Number.

Why Is This Information Required?

European Union and German regulations, including the Money Laundering Act, mandate Scalable Capital to verify customers’ identities. To comply, the data is collected during account opening. Nevertheless, it is kept private and not shared with any third-party organizations.

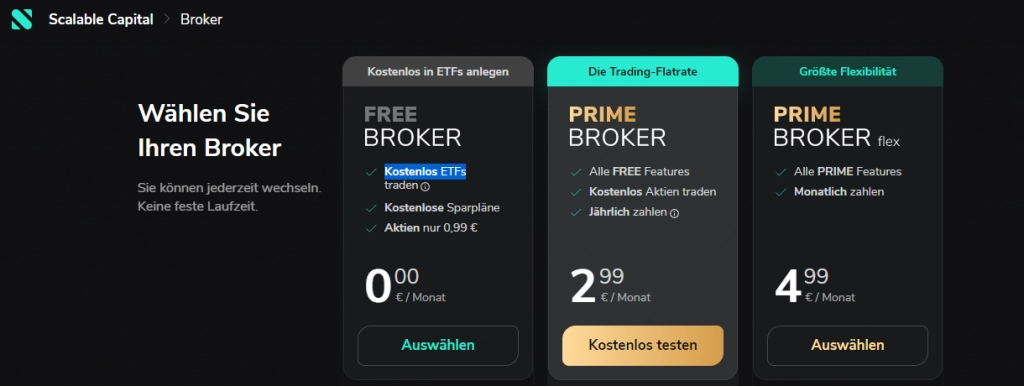

Step 4: Make Your First Deposit With Scalable Capital

Scalable Capital’s depositing process is fast and easy. You can use Direct Debit or Bank Transfer to make your payment. The type of account you select may require additional verification before making a deposit.

For new investors, starting with a small amount is better. A minimum investment would be €25, since it is the least required for a savings plan.

You can initiate a deposit via Scalable Capital’s web customer area or through the ScalableCap app. This is what the customer area looks like from the web login:

You can use the menu item to choose between two options for paying money to the clearing account:

- Deposit by bank transfer (1 to 2 working days)

- SEPA direct debit (3 to 4 bank working days)

Deposit by Bank Transfer

If you choose this option, the IBAN of Scalable Capital’s clearing account at Baader Bank will be displayed. You can transfer any amount from your own checking account to the clearing account.

To simplify the process, a QR code will be provided. You can scan it with your banking app and be on your way.

Your money will be in your account within 1-2 working days.

Please note that the checking account should be in your name or the transfer will not go through. Moreover, transfers via PayPal, Payback and Wise are not accepted.

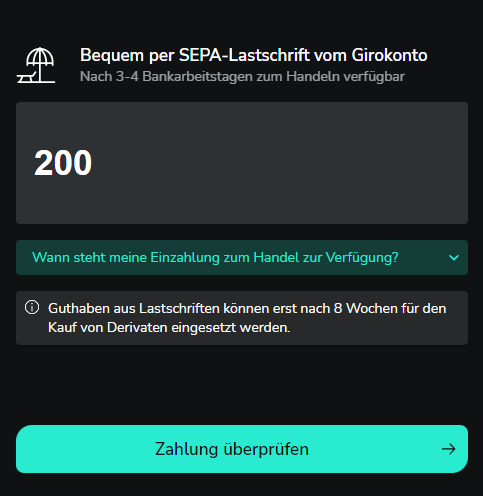

SEPA Direct Debit

The more easy way is to deposit by SEPA direct debit as you do not have to leave Scalable Capital’s environment. The image below shows how you can access it directly in the client area.

To use this option, you have to deposit at least €100. Moreover, you will have to wait longer as it will take 3 to 4 working days for the money to appear in your account. It takes longer as your bank has to confirm the direct debit.

If you plan on investing in derivatives, you will have to wait for up to 8 weeks.

Remember, always check all the information you have entered thoroughly before moving to the next step.

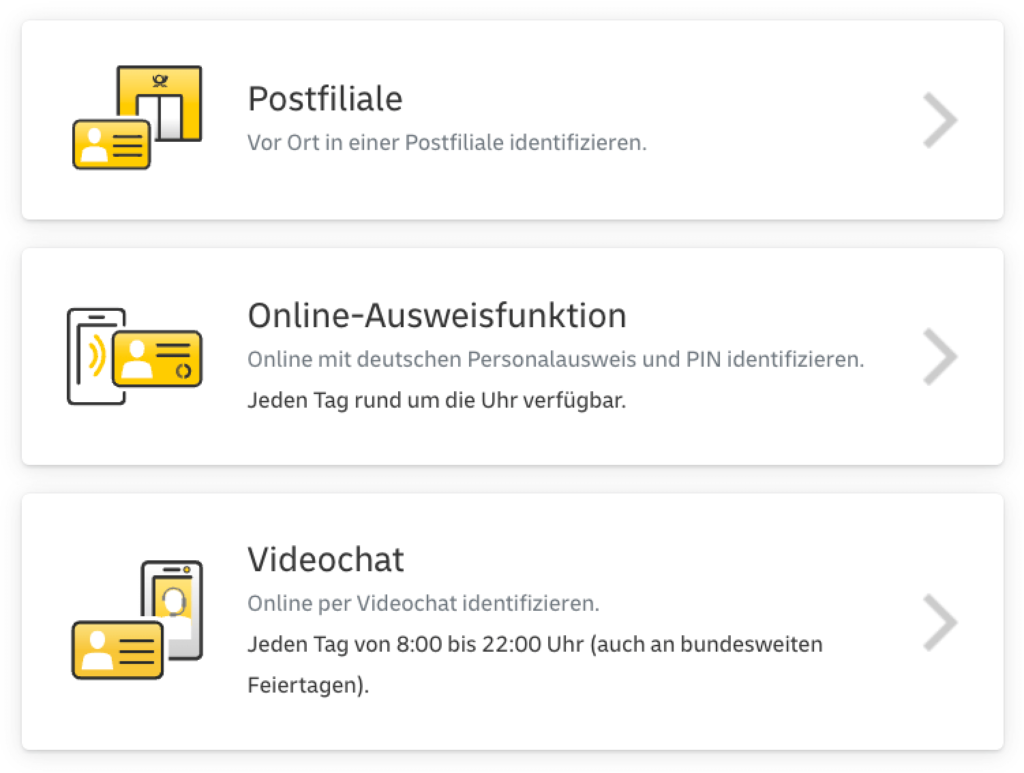

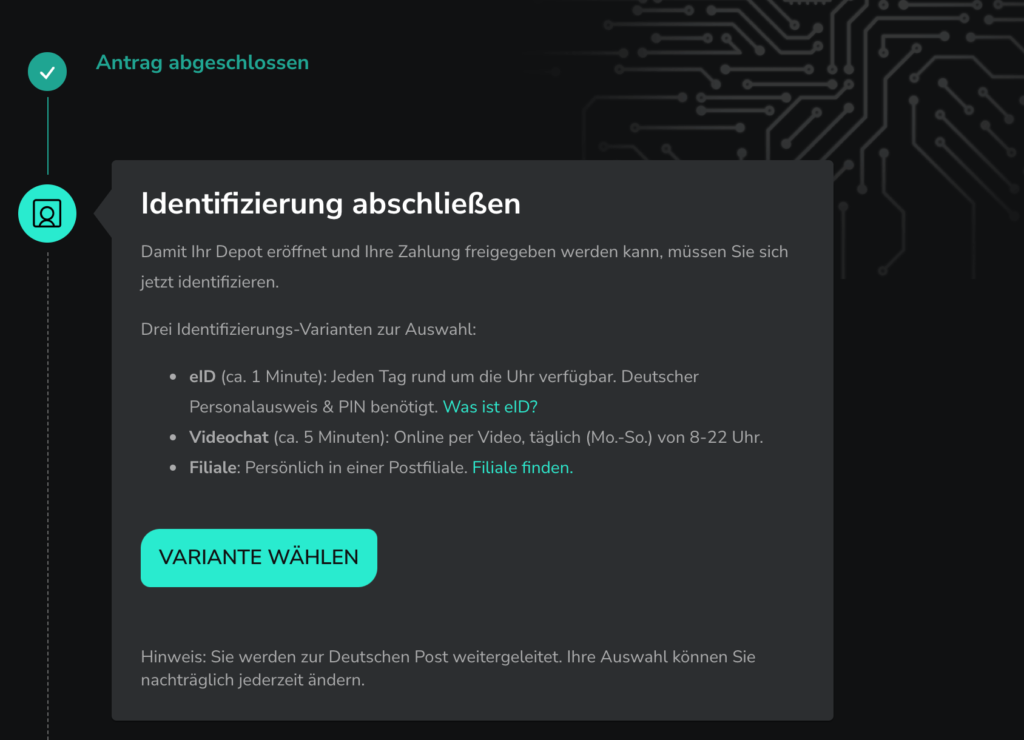

Step 5: Verify Your Identity WIth POSTIDENT

After agreeing to the Terms and Conditions, you will be directed to the Identity Verification stage. Scalable Capital has partnered with POSTIDENT to securely verify your identity.

There are three ways to verify your identity:

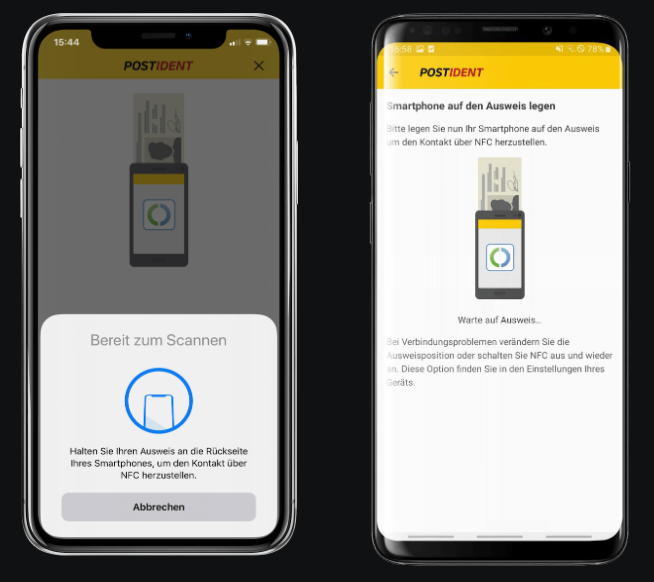

1. Verify With the POSTIDENT App

All you need is your German residency card and you can get verified within seconds, let alone minutes. You can also use your driver’s license issued by a German body to get verified. Just download the POSTIDENT app, scan your card, and you are verified.

2. Verify Identity Online by Video

If you have a foreign identity or passport, you can verify through this option. Have your passport nearby and follow the steps. You will be asked to hold it next to your face, so make sure there is enough lighting.

3. Identification in-Person at a Post Office Branch

If you cannot verify through video, you will be forced to make a trip to the nearest post office. They will scan your document and probably also take your fingerprints. It is easier than it sounds.

Once the verification is complete, you are all set. There is nothing more to follow upon. In a couple of days, your deposit will be completed and you can use Scalable Capital.